Bear Markets

Everything You Need To Know About Bear Markets

Experts define bear markets as a sustained period of price drops in a stock or market, often 20% or more from a recent peak. Typically, investors monitor the world's major indexes, such as the S&P 500 and the Dow Jones Industrial Average, to observe when they enter the bear market zone.

Individual equities or asset classes can potentially enter a bear market if their prices fall by 20% or more. The good news is that bear markets seldom endure long. According to the Schwab Center for Financial Research, the typical bear market lasts around 15 months.

What is a bear market?

There is no perfect science for defining or recognizing a bear market. However, market observers commonly define a bear market as a loss of 20% or more.

Bear markets frequently occur before an economic collapse, implying that investors are beginning to withdraw. A bear market, or "bear-market territory," is commonly defined as a larger ratio of risk-averse investors to risk-tolerant ones.

In a bull market, on the other hand, investors race ahead and frequently buy at a quick speed.

When investors hear that markets may be heading for a bear market or have entered the bear market territory, it is critical to pay the note and be prepared to alter your investments as needed.

Bear markets sometimes precede recessions, but they may also occur amid longer-term bull markets, indicating a temporary slowdown. Because it's impossible to predict which direction markets will swing and when keeping a watch on your assets is critical.

Economy overheats due to runaway inflation, a political upheaval seeping into markets, overextending consumers, or something else different can trigger bear markets.

How severe are bear markets?

Although investors fear bear markets, they are often short-lived.

As previously stated, the average bear market lasts around 15 months. Meanwhile, the shortest bear market in history occurred in 2020, with the start of the COVID pandemic.

Bear markets may make investors nervous, causing them to sell assets out of fear rather than due to bear market factors alone.

This has the potential to spread and deepen a bear market. Investors with no intention of selling might become engulfed in a contagious selling frenzy, leading to the sale of assets that may be more valuable in the long run.

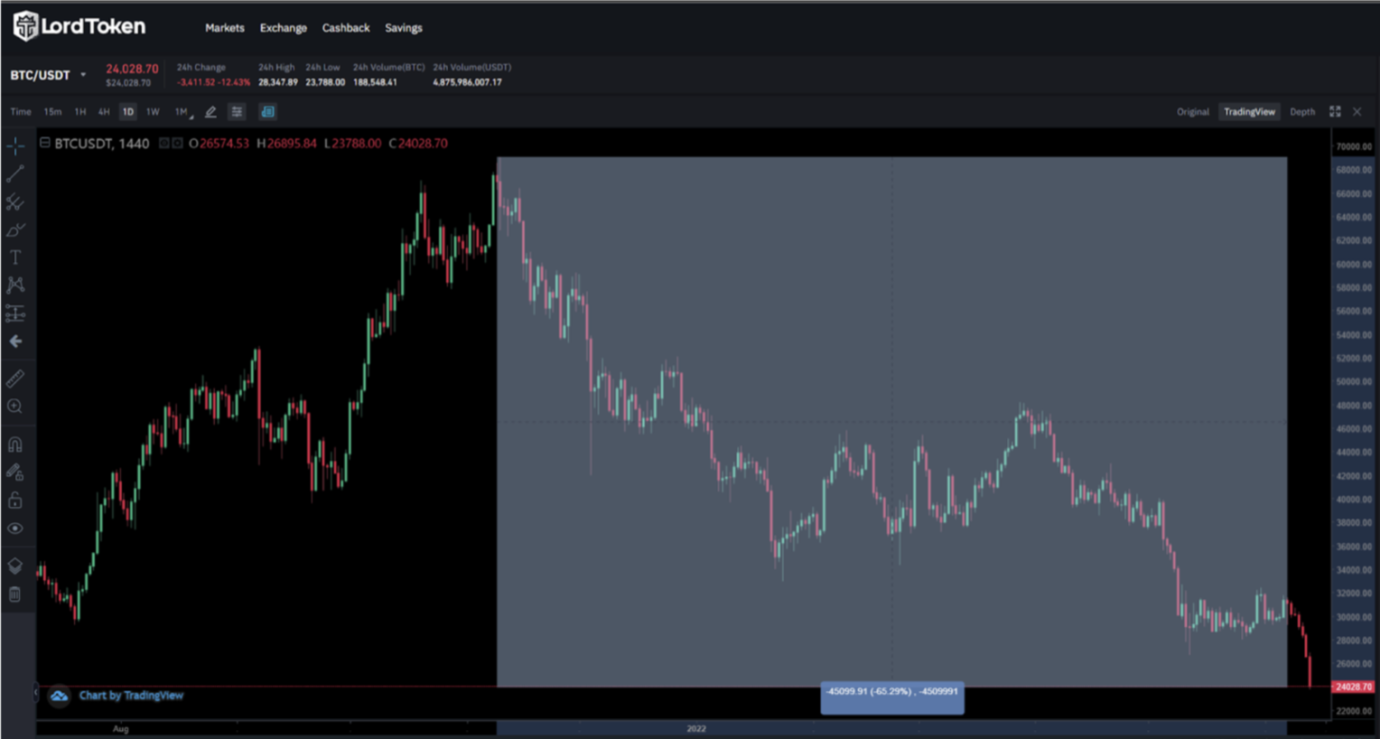

To find out the severity of bear markets, let's look at the BTC chart below,

Bitcoin hit an all-time high of $66,000 in November 2021 and has been falling since then; the whole crypto market is officially in a bearish trend (June 2022).

The market capitalization has fallen from $3trillion to $930billion.

BTC has lost more than 60% of its value, and the altcoins are also bleeding.

It becomes essential to hedge your positions, have a diversified portfolio and invest wisely in these times.

Market Correction vs. Bear Market

Investors unfamiliar with the stock market sometimes confuse a stock market correction with a bear market. Because they are so dissimilar, investors that confuse them lose a significant amount of money.

A market correction is a short-term occurrence in which the prices of stocks that are overpriced in comparison to their financials fall dramatically.

A two-month correction may provide an excellent entry point for investors to buy a stock at a lower price and wait for the correction to conclude for the stock price to return to the same level.

A bear market, on the other hand, occurs due to an economic, political, geological, or natural event and can last for years. In such a case, investors cannot discover a good entry point to buy a stock because the price may fall further and continue to decline for years.

As a result, investors may lose their entire investment and have liquidity for an extended time—a bear market in the stock market benefits short-sellers who benefit from a stock's price drop.

Conclusion

Bear markets can be brutal, but they are typically brief. While it may appear that selling during a bad market would be simple, timing the market may be difficult, even for pros. Hence, an investor can select high-quality assets to hold for the long term.

Constantly check positions that may require extra attention, such as growth stocks and possibly volatile investments.